Peacock Receives Investment from MarketScout Insurtech Ventures

June 22, 2021

Rate Moderation in Second Quarter 2021

July 1, 2021Personal Lines Rates Moderate

Hurricane and Wildfire Season Pending

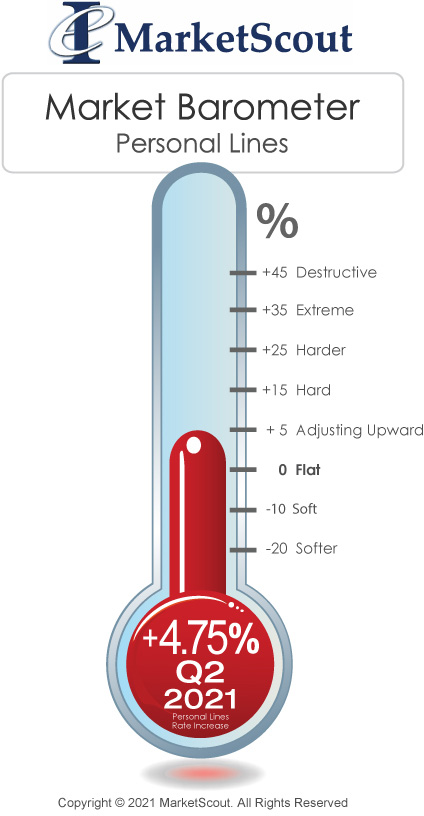

The personal lines composite rate is down slightly from quarter one to quarter two, 2021.

“Personal lines buyers are being assessed a second quarter rate increase of 4.75 percent as compared to 5.6 percent in the first quarter of 2021, said Richard Kerr, CEO of MarketScout. “However, we are just entering the hurricane and wildfire seasons over the next five or six months so rates could change quickly. An increasing number of homeowners are using non-admitted insurers. When non-admitted insurers are hit with significant losses, they can adjust rates very quickly.”

All personal lines coverages were less expensive in the second quarter in comparison to the first.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout's analysis of market conditions. These surveys help to further corroborate MarketScout's actual findings, mathematically driven by new and renewal placements across the United States.

A summary of the second quarter 2021 personal lines rates is set forth below.

| Personal Lines | |

| Homeowners under $1,000,000 value | Up 4.6% |

| Homeowners over $1,000,000 value | Up 5.6% |

| Automobile | Up 4% |

| Personal Articles | Up 4% |

About MarketScout

Founded in 2000, MarketScout is an insurance distribution and underwriting company headquartered in Dallas, Texas. The company is a Lloyd’s Coverholder and MGA for US insurers with specialty expertise in workers’ compensation, private client solutions, energy, healthcare, fine art, equine, jewelry, professional liability, and many specialty programs. The company owns and operates the MarketScout Exchange, as well as over 40 other online and traditional underwriting and distribution venues. MarketScout is the founder of the Council for Insuring Private Clients (CIPC) and administers the Certified Personal Risk Manager (CPRM) designation in partnership with The National Alliance for Insurance Education & Research. MarketScout is the only insurance organization to receive The National Alliance’s exclusive partnership and endorsement. The company founded the Entrepreneurial Insurance Alliance (EIA) in 2007 to support insurance entrepreneurs and in 2017 founded the MarketScout InsurTech (MIT) venture fund. In January 2018, it launched an Incubator to accelerate start-up MGAs and assume operational functions for existing MGAs and insurers. MarketScout’s company culture and sense of community encourages growth, learning and collaboration. The company has been named as one of the Best Places to Work in Insurance by Business Insurance for nine consecutive years from 2012 to 2020. The company has offices in Alabama, Arkansas, Florida, Illinois, Nebraska, Pennsylvania, South Carolina, Tennessee, Texas, and Washington, DC. California license #0D60423.